Minnesota Garage Repair Shop Insurance

See How We're Different

or call us: (763) 242-1668

Common Business Insurance Policies

By: Matt Larsen

Owner of Capstone Insurance Group & Garage Repair Shop Insurance Advisor

763-242-1668

Index

Contact Us

Phone

Location

Navigating the world of insurance can be a daunting task, especially when it comes to insuring your garage repair shop. With a myriad of policies available, it's essential to understand what each one covers and how it can protect your business. This guide aims to provide comprehensive information on garage repair shop insurance in Minnesota, helping you make informed decisions that will safeguard your business.

Understanding Garage Repair Shop Insurance

Garage repair shop insurance is a specialized type of business insurance that protects auto repair shops from a variety of risks. These risks can range from property damage to employee injuries, and even lawsuits from dissatisfied customers. Given the nature of the work, garage repair shops are exposed to a unique set of challenges, making this specific type of insurance crucial.

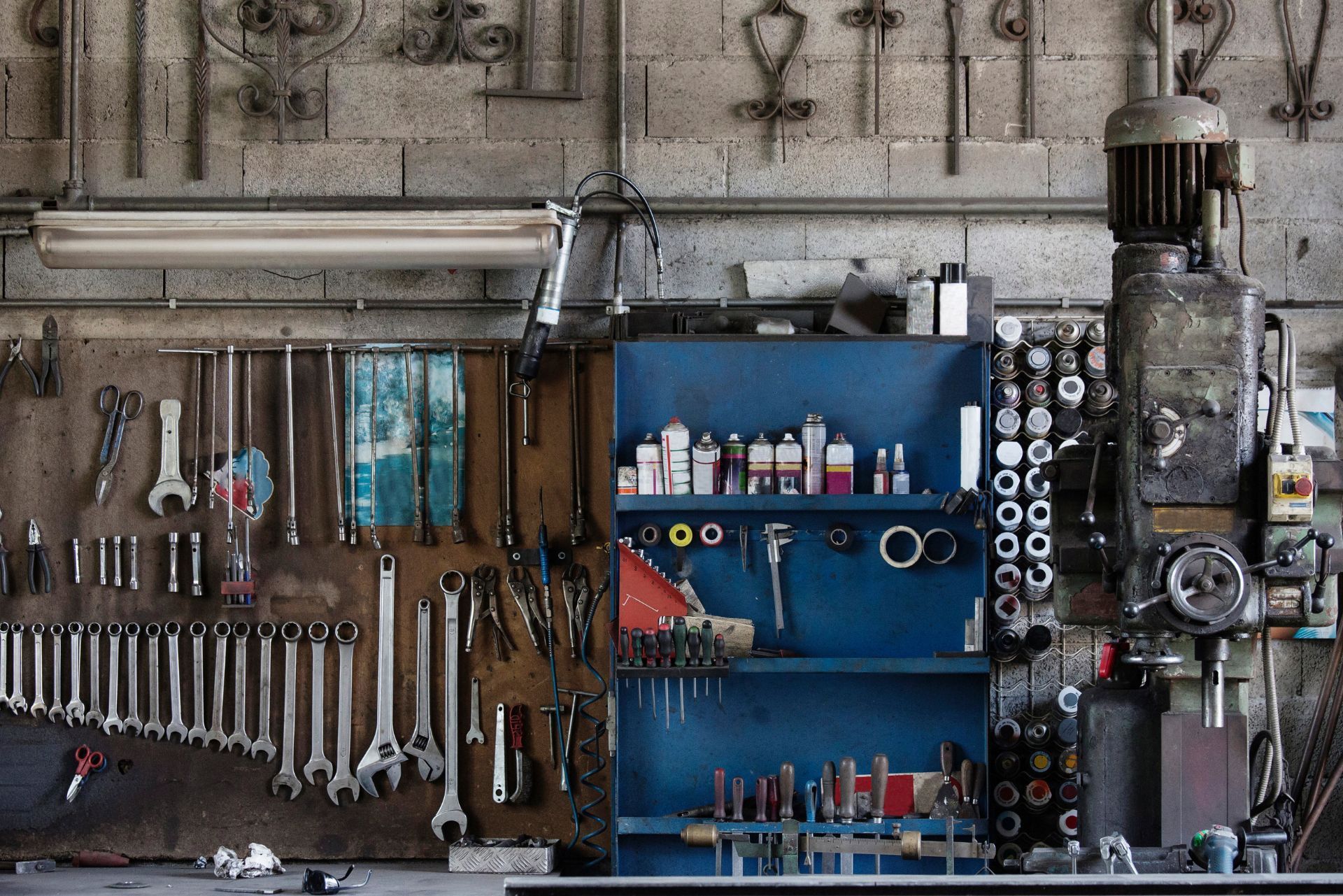

While general business insurance can offer some level of protection, garage repair shop insurance provides coverage tailored to the specific needs of auto repair businesses. This includes coverage for customer vehicles in your care, tools and equipment, and potential environmental hazards associated with the repair process.

Key Components of Garage Repair Shop Insurance

Garage repair shop insurance typically includes several key components. These include garage liability insurance, garage keepers insurance, business property insurance, and workers' compensation insurance. Each component offers protection against different types of risks.

Garage liability insurance covers bodily injury or property damage that may occur on your business premises or as a result of your operations. Garage keepers insurance, on the other hand, protects you against damage to customers' vehicles while they are in your care. Business property insurance covers your physical assets, such as your building, tools, and equipment. Lastly, workers' compensation insurance protects your employees if they get injured on the job.

Choosing the Right Garage Repair Shop Insurance in Minnesota

Choosing the right insurance for your garage repair shop in Minnesota involves understanding your business's specific needs and risks. This includes considering the size of your business, the number of employees, the types of services you offer, and the value of your equipment and tools.

It's also important to consider the legal requirements in Minnesota. For instance, Minnesota law requires businesses with employees to carry workers' compensation insurance. Failure to comply with this requirement can result in penalties and fines.

Working with an Insurance Agent

Working with an experienced insurance agent can be beneficial in choosing the right insurance for your garage repair shop. An agent can help you assess your business risks, explain the different types of coverage available, and guide you in selecting a policy that best fits your needs.

When choosing an insurance agent, consider their experience in the auto repair industry and their knowledge of Minnesota's insurance laws. An agent with industry-specific experience will be better equipped to understand your business's unique needs and recommend appropriate coverage.

Cost of Garage Repair Shop Insurance in Minnesota

The cost of garage repair shop insurance in Minnesota can vary greatly depending on several factors. These factors include the size of your business, the number of employees, the types of services you offer, the value of your equipment and tools, and your claims history.

While it can be tempting to choose the cheapest policy, it's important to ensure that you have adequate coverage to protect your business. Cutting corners on insurance can lead to significant financial losses in the event of a claim.

Ways to Lower Your Insurance Premiums

There are several ways to lower your garage repair shop insurance premiums. Implementing safety measures, such as regular equipment maintenance and employee safety training, can reduce the likelihood of accidents and claims, which can lower your premiums.

Choosing a higher deductible can also lower your premiums. However, it's important to ensure that you can afford to pay the deductible in the event of a claim. Bundling your insurance policies with the same insurer can also result in discounts.

Conclusion

Garage repair shop insurance is a crucial investment for any auto repair business in Minnesota. It provides protection against a variety of risks, helping to safeguard your business's financial stability. By understanding the different types of coverage available and working with an experienced insurance agent, you can choose a policy that meets your business's specific needs and risks.

While the cost of insurance can be a significant expense, there are ways to lower your premiums without compromising on coverage. Implementing safety measures, choosing a higher deductible, and bundling your policies can all help to make insurance more affordable. Remember, the goal is not just to find the cheapest policy, but to find the one that offers the best protection for your business.